Struck and Sons

Property Restoration Specialists | Since 1914

Family owned and operated. Restoring Rochester NY since 1914. Voted one of the top 100 business by the Greater Rochester Chamber of Commerce.

Family owned and operated. Restoring Rochester NY since 1914. Voted one of the top 100 business by the Greater Rochester Chamber of Commerce.

Our Services

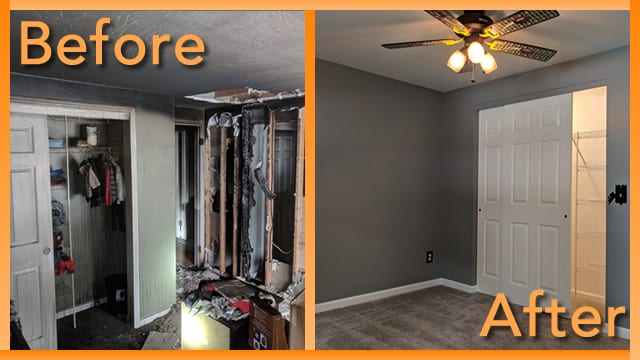

Fire Damage

Fire and smoke restoration

Water Damage

Water and mold remediation

Structural Damage

Foundation to rooftop repairs

Get Help Now

Call us 24/7 at 585-872-1947

East Rochester Chamber Presidents Award

The February 2024 Presidents Award recognizing a local business was presented to Owners Richard Struck, President and Ben Cook, VP of the Struck & Sons, by Thomas Fromberger, MRB Group and Martin D’Ambrose, Chamber President, Town/Village of East Rochester.

This monthly award recognizes the continued service and dedication as well as the lasting investment that the business has made to the Town/Village of East Rochester.

How can we help you?

Family Owned and Operated

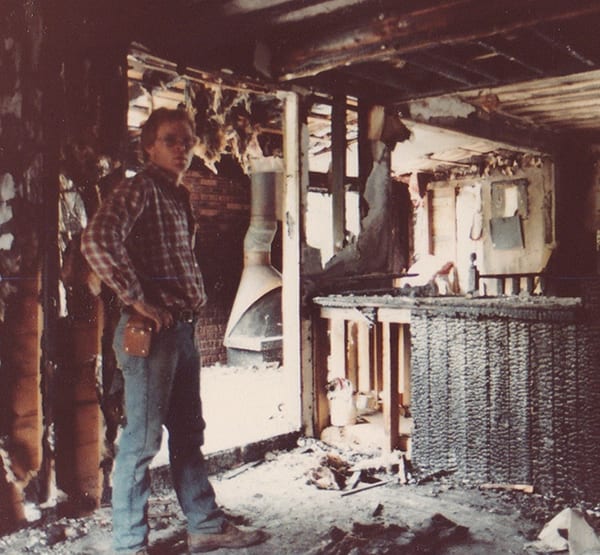

Struck and Sons is a family dedicated to helping people restore and rebuild after catastrophic events. Our team is ready to help regardless of the size of the project. We can help restore a water damaged bathroom or rebuild an entire home after a fire.

Our team is passionate about helping people. That is just one of the reasons our clients recommend us.

Trusted by the Penfield Community Center and Public Library

Struck and Sons helped the Penfield Community Center and Public Library transform the The Ruth Braman Room, the heart of the Community Center. The transformation included fresh paint, new carpet, and updates to the kitchen and storage space. New York State Assembly Member Jen Lunsford provided a grant of $20K in 2021 for the kitchen space, while the Town of Penfield provided additional funds and project support for the remaining renovations.

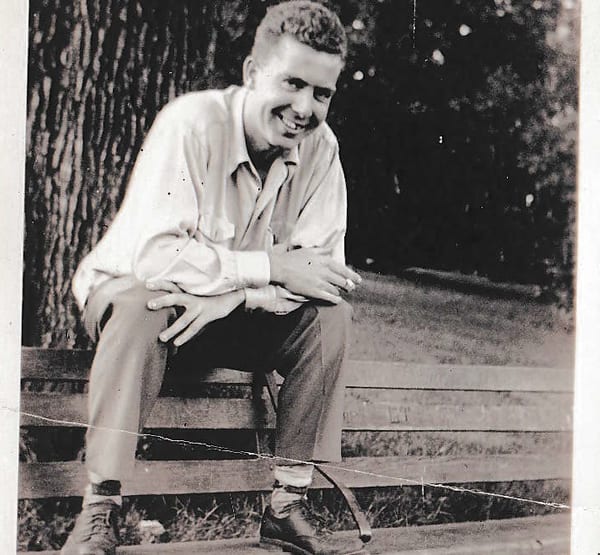

Over 100 Years and counting

The Struck Family have been building new and restoring damaged homes since 1914!

Today we at Struck and Sons, are in our 4th generation of family ownership. We proudly service the greater Rochester area offering specialized craftsmanship to those who have suffered damage to their homes.

Richard Struck Interview

News10NBC Investigates interviews Richard Struck about his decision to buy an unlivable Webster home in hopes to bring it back to life.

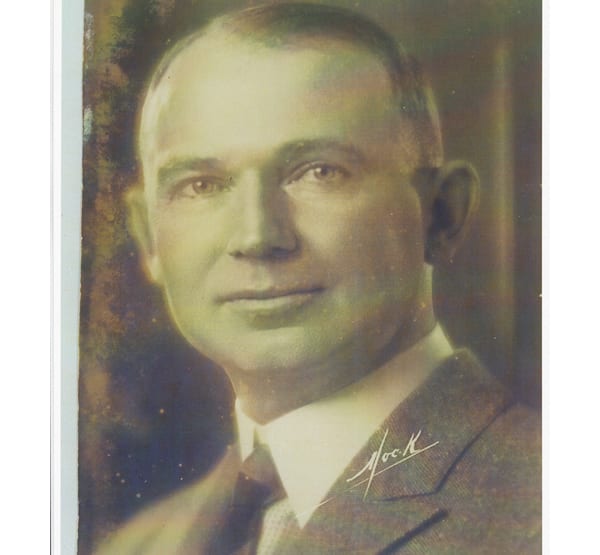

It all started in 1914

4 Generations of Experience

The Struck Family have been building new and restoring damaged homes since 1914! Leonard Struck (1882-1950) even developed a large area of Brighton called ‘Struckmar’.

Today we at Struck and Sons, are in our 4th generation of family ownership. We proudly service the greater Rochester area offering specialized craftsmanship to those who have suffered damage to their homes.

Through the years we have cultivated a team of expert tradesmen who take pride in their work and can maintain the high standards of the historic ‘Struck and Sons’.

Year we opened for business

Generations of Family members

Let’s Build Something Together

We couldn’t fit every question here, but we would love to talk to you! You can give us a call or use the website form to get in touch. With over 100 years of experience in repair and restoration we can answer just about any question you can throw at us. We would love to talk to you!

I have a small project, will you still help me?

Absolutely. We work on all different kinds of restorations, repairs, and even remodels. Any work to your property needs to be done correctly and to the highest standards of craftsmanship. Our team will give you our honest assessment of the best way to move forward on your specific project.

Do you work on commercial properties?

Yes! We work on both residential and commercial property. We can help you restore your structure back to its prior glory! Give us a call so we can talk about how best to help you!

Will you really give me an honest assessment of my project?

Absolutely! We don’t play games with estimates. We promise to give you an honest upfront estimate of the full cost of repairs. We want you to understand the full scope of the project as well as the correct methods to restore your property. We never take shortcuts and we won’t give you surprises. At Struck and Sons, we pride ourselves on our honesty and integrity.

How does this work with insurance?

We are used to dealing with insurance companies. Of course, companies have different procedures for claims and repairs but we can help advise during the repair phase of the process. Give us a call to talk about what types or repairs or restorations you need.

My home suffered damage, but I want to use this as an opportunity to upgrade, can I do that?

So, you want to make your damaged space better than before? We can help with that. From disaster to diamond we can turn your damaged space into a perfect restoration or make the space of your dreams. It’s all up to you. Give us a call to chat about how we can help.

Client Testimonials

Mike and Melissa experienced a horrible house fire just two months after moving in! See how we transferred a shell of their new home into their new dream home!

When Lynn’s home suffered damage due to an explosion she called Struck and Sons to get things back in order. We are pleased to have been able to use our expertise to help!

When Laurette’s home suffered water damage, she couldn’t trust just anyone to help correctly restore things. She called Struck and Sons to restore her home.